I’m happy Diversity won, but at the same time, I think that it’s a shame and a farce that Stavros Flatley didn’t even place!

Quote of the moment: You’ve got to have some Greek in you somewhere. No one is that cool who isn’t a big Greek.

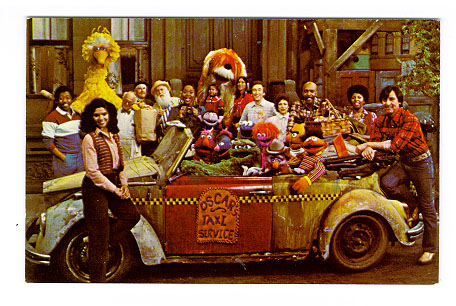

The dance act is quite cool though, so they’re going to wow the Queen :)